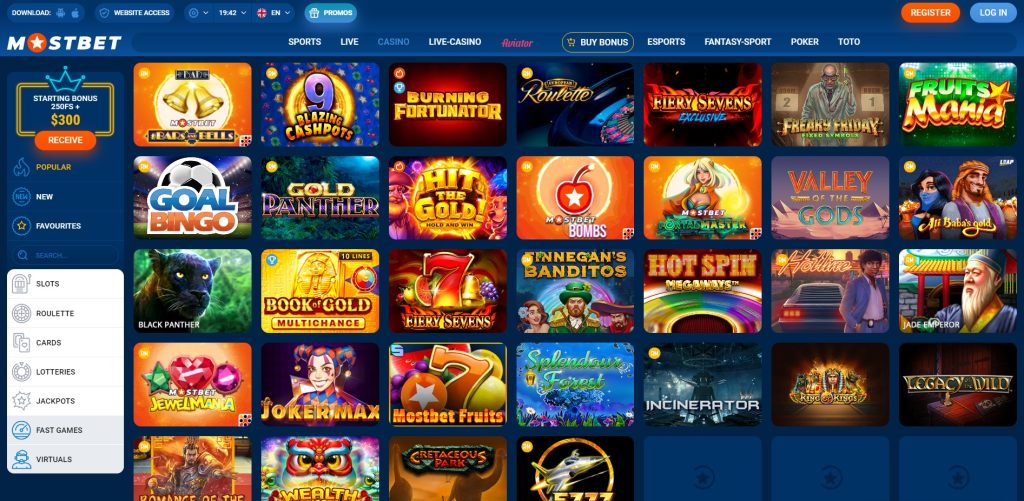

In the ever-evolving world of e-commerce and digital transactions, Bangladesh has rapidly embraced a range of payment methods that cater to its growing population of internet users. Understanding these options is essential for anyone engaging in online transactions in the country. From traditional bank transfers to innovative mobile wallets, the Bangladeshi payment landscape offers a variety of choices to meet the diverse needs of consumers. Among the various online platforms, the Bangladeshi Payment Methods for Online Casino Transactions Mostbet app has emerged as a notable player, providing users with access to a wide range of services. In this article, we will explore the most popular payment methods available in Bangladesh for online transactions.

1. Mobile Banking

Mobile banking has revolutionized the way people in Bangladesh conduct financial transactions. With the high penetration of mobile phones, nearly every individual with a device can access banking services through various mobile banking apps. Some of the most popular mobile banking services include:

- bKash: Perhaps the most well-known mobile financial service in Bangladesh, bKash allows users to send and receive money, pay bills, and make purchases from partner merchants. The service has gained immense popularity due to its ease of use and extensive network.

- Rocket: Run by NLBBL, Rocket is another widely used service that enables users to perform transactions seamlessly. Its user-friendly app and cash-out options at various kiosks make it a convenient choice.

- dbbl Mobile Banking: Dutch-Bangla Bank Limited (DBBL) offers its mobile banking services with features like fund transfers, utility bill payments, and instant account access.

2. Digital Wallets

Digital wallets have gained traction in Bangladesh, as they provide a secure and efficient means of making online payments. Some notable digital wallets include:

- Payoneer: Known globally, Payoneer allows Bangladeshi freelancers and businesses to receive payments from international clients. The ability to withdraw funds locally makes it popular among the freelance community.

- GPAY: Offered by Grameenphone, this service allows users to transfer money and pay bills. Its integration with the user’s mobile credit makes it an attractive option for seamless transactions.

3. Bank Transfers

For individuals and businesses seeking to make larger transactions or pay suppliers, traditional banking methods remain relevant. Most banks in Bangladesh offer online banking services that allow users to transfer funds electronically. Users can initiate transactions via:

- Online Bank Transfers: With the advancement of internet banking, many banks offer the ability to transfer funds directly to other bank accounts within Bangladesh through NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement).

- Cheque Payments: While less common for online transactions, cheques are still used for significant payments, especially in B2B transactions.

4. Cash on Delivery (CoD)

Despite the rise of digital payments, Cash on Delivery remains a popular payment option for online shopping in Bangladesh. Many e-commerce platforms offer this payment method, enabling consumers to pay for goods upon delivery. The trust associated with CoD has made it a preferred choice among customers wary of online scams.

5. Payment Gateways

As e-commerce continues to flourish, the importance of secure payment gateways has become increasingly evident. Payment gateways facilitate online transactions by acting as intermediaries between customers and merchants. They encrypt sensitive information and ensure secure transactions. Some popular payment gateways in Bangladesh include:

- SSLCommerz: This is one of the largest payment gateway providers in Bangladesh, allowing merchants to accept payments via credit cards, mobile banking, and other methods.

- Razorpay: Although it originated in India, Razorpay offers services in Bangladesh, enabling businesses to receive payments in multiple currencies.

6. Cryptocurrencies

While still evolving, the acceptance of cryptocurrencies is gradually emerging in Bangladesh. Though there are existing regulations that restrict direct cryptocurrency transactions, reports indicate a growing interest among tech-savvy individuals. Platforms are being established where users can trade cryptocurrencies, take advantage of global trends, and diversify their investment portfolios.

7. Regulatory Landscape

Bangladesh Bank, the central bank of the country, regulates payment systems and financial institutions. Recently, it has taken steps to encourage digital payment solutions in a bid to promote financial inclusion and stimulate economic growth. Understanding the regulations surrounding digital payments is crucial for both consumers and businesses as the landscape continues to develop.

Conclusion

As Bangladesh continues to embrace digitalization, its payment methods for online transactions are diversifying to meet the needs of its consumers. The blend of traditional systems like bank transfers and innovative approaches such as mobile banking and digital wallets is shaping the future of financial transactions in the country. Whether you are a consumer looking to make online purchases or a business seeking to reach a wider audience, familiarizing yourself with these payment methods will empower you to navigate the bustling Bangladeshi online marketplace.